Legal Briefs & Resources

Contact Kim Hoggan at khoggan@saanys.org with any legal and negotiation services questions.

2024 Negotiations Webinar

Strategies for Successful Negotiations

Although this booklet provides important information, it is not intended to be a viable substitute to speaking directly with a SAANYS attorney or negotiator. If you are nearing the time to negotiate a new contract, please call SAANYS at (518) 782-0600 or email Kim Hoggan at khoggan@saanys.org.

Employment Termination and Position Abolishment in Uncertain Times – Updated April 2020

This newly updated guidebook outlines the legal processes involved in termination and members’ related legal rights. Also discussed within are tenure areas, transfers, bumping rights, seniority/preferred lists, and more. This booklet is an especially important resource for members while addressing staffing and employment issues in our current environment. Download the booklet today by clicking here.

Legal Briefs

The School Administrators Association of New York State (SAANYS) recently achieved a significant win for a retired administrator at Berne-Knox-Westerlo Central School District, securing full payment of Medicare premium costs, including Income-Related Monthly Adjustment Amount (IRMAA) payments.

SAANYS General Counsel Arthur P. Scheuermann advocated on behalf of Susan Sloma, a former district employee and Helderberg Administrators’ Association President and member, who was approaching Medicare eligibility at age 65. When Ms. Sloma learned she would be enrolled in the District’s Medicare Advantage Plan effective July 1, 2025, questions arose regarding the district’s responsibility for premium payments.

In correspondence to District officials, including Bonnie Kane on April 9, 2025, SAANYS cited Section 9.4.3 of the collective bargaining agreement, which states: “The District will… pay 100% of all premium costs for health insurance in retirement for life for those employees eligible for paid health insurance in retirement for life.”

The letter also referenced a significant precedent established in Tryon v. Cobleskill-Richmondville Central School District (2023), where the court held that districts are obligated to pay IRMAA premiums when a collective bargaining agreement provides for 100% coverage of premium contributions.

Within days of receiving SAANYS’ letter, the District Kane acknowledged and confirmed the its prior agreement to cover 100% of the premium costs for Ms. Sloma’s Medicare Advantage Plan, bringing the matter to a swift and favorable resolution.

This successful advocacy demonstrates the importance of clear contract language regarding retiree benefits and SAANYS’ commitment to protecting the healthcare benefits that school administrators have earned through their years of service.

If you are unsure of your contractually guaranteed benefits or are experiencing pushback from your district when trying to claim benefits, contact your union representative and your SAANYS legal counsel to begin exploring your options for remediation.

In a win for a class of retired school administrators, the Liverpool Central School District has agreed to rescind changes to prescription drug coverage that would have required pre-authorization for medications.

The case began when the district implemented a new prescription drug pre-authorization requirement through a company called ProAct on June 1, 2024. This change affected retired administrators who had collectively bargained for retirement health insurance benefits that guaranteed they would maintain the same benefit levels and contribution rates that were in place during their final year of active employment. Consequentially, retired employees found themselves being denied their certain prescription drugs or having to engage in extensive communications to maintain maintenance drugs they were prescribed.

The School Administrators Association of New York State (SAANYS) filed a Notice of Claim on behalf of the affected retirees in August 2024. The claim cited Article 13.5.1 of the 2008-2012 collective bargaining agreement, which specifically provided that retired administrators “shall be permitted to participate at the benefit level(s) and contribution rate(s) in place at the time the administrator was last active.” At that time, the health insurance plan did not require pre- authorization for prescription drugs.

SAANYS General Counsel Arthur P. Scheuermann represented the retirees in negotiations with the district. By mid-April 2025, the district agreed to reverse course, eliminating the pre-authorization requirement and reinstating the prescription drug coverage as it existed under the retirees’ contracts.

Also of note, this reinstatement applies to all subscribers of the plan who originally retired with this benefit, not just those who were named in the original claim.

This case highlights the value of SAANYS membership and the importance of protecting negotiated retirement benefits. The successful resolution demonstrates how collective action through professional associations can safeguard healthcare benefits that retirees depend upon.

SAANYS continues to advocate for the protection of contractual rights for both active and retired administrators across New York State. If you have experienced a change like this in your contract, contact your union representative and your SAANYS legal counsel to begin exploring your options for remediation.

SAANYS General Counsel Arthur P. Scheuermann and Counsel Brian Deinhart secured a major victory for Maria P. Dorr. More than a year since she was first put on administrative reassignment, Dorr, the longest serving principal of Amagansett Union Free School District in recent history, has been completely cleared of all misconduct charges in a recent 3020(a) arbitration hearing.

The decision, dated March 20, 2025, by Hearing Officer Timothy S. Taylor, also represents a significant victory for school administrators facing potentially career-ending allegations. The Amagansett Union Free School District brought serious charges against Dorr: alleging theft of an envelope and gift card, claiming she attempted to suppress information about the incident, and then further arguing that she provided false statements during an investigation.

What began as a seemingly straightforward accusation quickly crumbled when brought to a hearing. The district sought Dorr’s termination, presenting what appeared at first glance to be damaging evidence. However, the hearing process revealed a deeply flawed investigation that failed to meet the fundamental standards of fairness and factual accuracy.

At the heart of the case was a missing red envelope, allegedly taken from another employee’s mailbox during the busy holiday season. The district’s primary witness, school receptionist Cassie Butts, was found to lack credibility. Her quick spread of unsubstantiated rumors about Dorr and inability to provide concrete evidence became a critical weakness in the district’s case.

Interim Superintendent Richard Loeschner’s investigation came under particularly sharp criticism. The arbitrator identified multiple investigatory failures, including a narrow focus on only certain red envelopes, failure to interview key witnesses, and a mailroom without security cameras. Perhaps most damning was the suggestion of bias, with Loeschner reportedly receiving guidance from teacher association leaders before conducting an incomplete investigation.

The arbitrator’s decision was unequivocal. Not only was Dorr found not guilty of all charges, but the ruling also mandated her immediate reinstatement and required the district to expunge all records of the disciplinary proceedings. The district must also make Dorr whole, meaning they must acknowledge the professional and personal harm caused by the unfounded accusations.

This case is a poignant example for school districts of the delicate balance required in professional misconduct investigations. It highlights the critical need for school districts to conduct comprehensive, unbiased, and thorough investigations before bringing serious charges against administrators. The arbitrary pursuit of allegations without substantive evidence can cause irreparable damage to professional reputations and careers.

For school administrators, the Dorr case offers a crucial lesson in the importance of due process and the value of robust legal representation. It demonstrates that a meticulously prepared defense can expose the weaknesses in hastily constructed accusations. It also emphasizes the importance of documentation as an administrator. Dorr’s defense was greatly aided by the meticulous notes and records that she kept pertaining to her work as building principal. This was only further highlighted by the district’s relative inability to produce documentation from their investigation and ultimately was one of the factors that swayed the outcome of the case in Dorr’s favor.

This arbitration stands as a testament to the importance of protecting professional integrity and ensuring that disciplinary actions are based on clear, credible evidence rather than speculation or rumor. If you are in a situation in which you feel that your district may begin pursuing disciplinary action via a 3020(a) arbitration, contact your union representative and SAANYS legal counsel to see what options you have for recourse.

In a significant development for Long Beach City School District’s psychologists, a long-standing compensation dispute regarding Committee on Special Education (CSE) chair duties has been resolved through successful negotiations between the district and the Long Beach Administrative, Supervisory and Pupil Personnel Group “Group”) after the Group had filed a grievance.

The dispute began with a grievance filed in November 2024 by the union. The Grievance brought to light that since 2001, many District psychologists serving as CSE chairs were entitled to additional compensation of $1,000 annually for their services but did not receive it. The psychologists were either uninformed of this benefit upon hiring or mistakenly believed the stipend was automatically paid. This miscommunication serves as a reminder that every administrator and supervisor each July should review his/her contract to ensure all compensation is correctly paid.

The dispute affected thirteen psychologists who had served as CSE chairs between the 2006-07 and 2021-22 school years, with some veterans having performed these duties for up to 17 years without proper compensation. The total claimed compensation amounted to approximately $144,800, representing many years of unpaid stipends for affected staff members.

While the grievance was initially denied at Stage One and Stage Two, the Board of Education then proposed a settlement in the spirit of maintaining positive labor relations.

Looking forward, the district has agreed to increase the CSE chair stipend from $1,250 to $2,000 under the new current five-year contract. This increased stipend amount will remain in effect until 2029, at which point it will revert back to $1,250/year unless renegotiated. Though some veteran staff members expressed disappointment with the sunset provision, union leadership emphasized that this represents a significant improvement over potentially receiving no compensation adjustment at all since under arbitral law, damages would be limited to the current school year because of the statute of limitations expired.

This case highlights the importance of contract awareness among educational professionals. “The moral is to be vigilant in understanding your contract and understanding what benefits you are entitled to receive,” noted SAANYS counsel Arthur P. Scheuermann. The settlement serves as a reminder of the value of both careful contract review and cooperative problem-solving between school districts and their professional staff.

Does the use of generative artificial intelligence, such as ChatGPT or ClaudeAI, violate the Family Educational Rights and Privacy Act (commonly abbreviated as “FERPA”)? It certainly can. Let’s dive in.

FERPA was introduced in 1974 as 20 USC§ 1232g, with accompanying regulations found at 34 CFR Part 99, to protect student privacy by preventing unauthorized disclosures of “education records.” The statute defines “education records” broadly, including “information directly related to a student” that “are maintained by an educational agency or institution or by a person acting for such agency or institution.” Prior to releasing education records, an educational agency must obtain “written consent from the student’s parents specifying records to be released, the reasons for such release, and to whom, and with a copy of the records to be released to the student’s parents and the student if desired by the parents.”

But what does this mean for educators? Let’s look at a sample privacy policy of a big player in the field. As of the writing of this article, OpenAI’s privacy policy[1] for ChatGPT allows OpenAI to “disclose your Personal Data” to “Vendors and Service Providers,” “Government Authorities or Other Third Parties,” “Affiliates,” or “Business Account Administrators.” More details are buried in the longer “Data Processing Addendum,” including []. Moreover, OpenAI will “retain your Personal Data for only as long as we need in order to provide our Services to you,” i.e., the company can retain information inputted into ChatGPT indefinitely.

Data inputted into a generative AI platform may be processed locally (e.g., on your device or on a company server) or remotely (e.g., on an OpenAI or Amazon Web Services server). It’s possible that the user may retain custody of the locally-processed data. However, it’s also possible that some data is sent to remote servers for telemetric purposes. Software telemetry generally refers to automatically collecting data related to the deployment of software. Without using a network monitor, it’d be difficult, if not impossible, to determine whether local generative AI sends data to a remote server. Further, it’d also be difficult, if not impossible, to determine what data is sent. Therefore, assurances that data is processed locally when using a generative AI platform may not be the panacea we had hoped it would be.

Also noteworthy is that OpenAI can change its privacy policy at any time. Yet, the company will be the custodian of the data you input indefinitely. Thus, data input in 2024 under one privacy policy may be subject to different terms and conditions under a future privacy policy. Further, if part or all of OpenAI is sold, another owner, which may be a foreign entity, will be the custodian of the data.

How does this play out in practice? If an educator drafts an email to a Director of Pupil Personnel Services regarding a specific special education student, including their name and specifics regarding their disabilities, and then uses generative AI to proofread that email, it’s possible that that would be an unauthorized disclosure of that student’s education records. Should OpenAI be hacked or use that student’s information in an output to another user, it could come to light that education records were disclosed to third parties without authorization. Further, it’s possible that a savvy district could be monitoring internet traffic for traffic to known generative AI platforms, e.g., Copilot, ChatGPT, or ClaudeAI.

It’s important to understand what data you’re inputting into a generative AI platform, where that data goes, where and how that data is stored, and how the data is used. Sometimes it’s best to hold off on using that proofreading function, or consider scrubbing any and all education records from the input. If there’s a question or concern, please contact the SAANYS Office of Counsel at 518-782-0600.

The contents of this communication are intended to convey general information only and not to provide legal advice or opinions. The contents of this communication should not be construed as, and should not be relied upon for, legal advice in any circumstance or fact situation. The information presented in this communication may not reflect the most current legal developments. No action should be taken in reliance on the information contained in this communication and we disclaim all liability in respect to actions taken or not taken based on any or all of the contents of this site to the fullest extent permitted by law. An attorney should be contacted for advice on specific legal issues.

[1] Note that data input to ChatGPT through integration in Apple products may be subject to OpenAI’s Privacy Policy under circumstance but not others. Parsing the differences between the circumstances is beyond the scope of this article.

Tenure requires the following two elements:

(1) a tenure recommendation of the superintendent; and

(2), an affirmative tenure vote of the board of education.

Without both actions, a school administrator will not receive tenure and will be terminated at the end of their probationary term. Alternatively, the administrator may be asked to extend their probation by executing a Juul Agreement.

When a school administrator receives notice of a Juul agreement offer instead of tenure, it marks a pivotal moment in their career that requires careful consideration. Named after the landmark case Juul v. Board of Ed. of Hempstead, these agreements extend an administrator’s probationary period for an additional year when the superintendent has decided not to recommend tenure.

A Juul agreement is a legally binding contract that must be voluntarily entered into by both the administrator and the school district. By accepting, an administrator waives their right to claim tenure by estoppel, and the agreement must be executed before the probationary period expires. While acceptance doesn’t guarantee future tenure, it provides an opportunity to address identified areas of concern and demonstrate growth.

Upon receiving a Juul agreement offer, immediate action is essential. Request comprehensive written documentation from your district, including specific reasons why tenure isn’t being recommended at that time, copies of all evaluations, and clear documentation of any concerns. This information is crucial for making an informed decision and planning your approach to the extension year if you accept.

Consulting SAANYS, or a union representative should be an early priority. SAANYS will view your collective bargaining agreement to determine if it contains a provision regarding probation and/or tenure. SAANYS can provide valuable insights and explanations regarding the agreement’s terms and help you to understand your rights. This knowledge and guidance will enable you to evaluate fully whether the concerns raised are addressable and assess your professional options.

If you accept the agreement, the extension year becomes critical for professional development. Create a detailed improvement plan with a couple of objectively based, measurable goals, actively seek professional development opportunities, and maintain comprehensive documentation of your efforts to address concerns. Regular communication with supervisors will demonstrate your commitment to improvement. Periodic written feedback will also ensure you’re meeting expectations, or not. Keep SAANYS counsel and/or your union representatives informed of significant developments.

For those administrators who feel that the district is simply providing you time to secure other employment, you are faced with a serious situation of securing employment before the end of your probationary term or executing the Juul Agreement to afford you the necessary time to focus on obtaining new employment.

Critical to this decision is the firm belief that it is better to have a job while looking for a new one than to be unemployed and looking for new employment. Under either scenario, begin your job search immediately, request letters of recommendation from supportive colleagues, and prepare for transition to positions in other districts or educational settings that might better align with your professional goals. An important aspect of future employability is to answer questions regarding your departure from your present job. Be confident in explaining why you are leaving your current employer. Speaking with SAANYS’ legal department in this regard is vital as well, because counsel will offer suggestions of how to address the situation with prospective employers.

To recap, remember that receiving a Juul agreement, while challenging, isn’t necessarily a career setback. Many administrators have successfully navigated this situation and achieved their professional goals. Success comes from making informed decisions based on careful consideration of all factors, maintaining professionalism throughout the process, and approaching the situation with dedication to educational excellence.

By viewing this experience through the lens of professional growth and maintaining a proactive stance, administrators can use this period as an opportunity to strengthen their leadership skills and advance their careers in education. SAANYS offers substantial resources and support systems to help navigate these challenges, ensuring that administrators facing this situation have the tools they need to make informed decisions about their professional future.

.

SAANYS secured a significant legal victory recently when the Oswego County Supreme Court ruled that one Oswego City School District board of education illegally voted to strip a tenured administrator of her tenure. The district attempted to “reappoint” the administrator to a second probationary term in her position on the basis that she did not hold the appropriate certification for that position at the time her tenure appointment was made. Following the tenure appointment, and before the board voted in favor of the second probationary term, the administrator did, in fact, obtain the requisite certification.

SAANYS challenged the board’s actions on the basis that once an administrator receives a tenure appointment, the sole method by which the district can remove the administrator from her tenured position is through the procedures prescribed in Section 3020-a of the Education Law. Section 3020-a entitles a tenured administrator to a hearing before a neutral arbitrator before any discipline may be imposed.

In papers submitted to the court, the district’s attorneys argued that the board’s actions were justified because the administrator’s lack of the appropriate certification required by the Commissioner of Education rendered the administrator’s employment illegal under the Education Law at the time she received her tenure appointment. Therefore, the district claimed, the board of education was without authority to confer tenure, and the administrator was not entitled to tenure protections.

The court held unequivocally that once the tenure appointment was made, the administrator was entitled to a 3020-a hearing. That she did not possess the correct certification was of no consequence. Removal of the administrator—even for possessing the incorrect certification—requires a hearing. Because the administrator now possesses the correct certification, however, the district cannot seek termination on that basis.

Recent changes in how the New York State Teachers’ Retirement System (TRS) handles post-retirement employment have created new challenges and opportunities for school administrators planning their retirement transitions. Understanding these evolving regulations is crucial for all members, regardless of whether or not you are soon approaching this point.

Bona Fide Termination Requirements

The retirement landscape has shifted significantly over the past two years, with both the Employees’ Retirement System (ERS) and TRS implementing stricter scrutiny of retirees returning to work. The previous standard of simply being removed from payroll with a one-day gap before reemployment is no longer sufficient. Instead, both systems now require a “bona fide termination of employment.”

To avoid challenges to your retirement benefits, administrators should observe a minimum two-month separation period from their former employer. During this time, there should be no evidence of discussions or agreements regarding potential rehiring.

COVID-Related Suspensions and Their Impact

Currently, administrators benefit from the suspension of certain Retirement and Social Security Law restrictions, specifically Sections 211 and 212. Historically, retirees could only be hired with no limitations to their compensation if they received a Section 211 waiver—which was normally only attainable if the employer could show that the vacancy being filled was unexpected and that efforts to hire a non-retiree had failed. In addition, waivers would not be granted if the employer was a former employer (this is based on compensation and/or pension benefits in the last two years pre-retirement). In addition, Section 212 limits the amount of compensation a rehired retiree can receive to $35,000 for the calendar year.

While these restrictions were both suspended during COVID, the suspension will only last through June 30, 2025. Whether or not these restrictions will change again in light of teacher shortages is not currently known.

Additionally, suspension of these restrictions applies exclusively to public school districts and BOCES employment. Members should note that work with charter schools, community colleges, SUNY institutions, or other public employers remains subject to the original Section 211 and 212 requirements. This distinction is crucial for retirees considering various post-retirement opportunities.

Consulting Work Under Scrutiny

Administrators planning to engage in consulting work face additional considerations. Whether operating independently or through a consulting firm, TRS maintains oversight of these arrangements. The agency now routinely requests contract reviews to evaluate whether the consulting work mirrors administrative or teaching duties. When similarities exist, these positions may still fall under Sections 211 and 212 regulations.

To ensure compliance and protect retirement benefits, administrators should:

1. Submit consulting contracts to TRS for review well before beginning any work

2. Maintain clear documentation of all employment transitions

3. Avoid any appearance of pre-arranged employment during the two-month separation period

4. Carefully track earnings from different educational employers

5. Stay informed about potential changes to the current suspension of restrictions

The stakes for non-compliance are significant. TRS has the authority to withhold retirement benefits or require repayment of improperly paid pension benefits. These penalties can have substantial financial implications for retirees.

Looking Ahead

With the current suspension of restrictions set to expire in June 2025, administrators should prepare for potential changes in the regulatory landscape. Those planning to retire in the coming years should carefully consider timing and post-retirement employment options in light of these regulations.

The retirement system provides comprehensive resources for administrators navigating these requirements, including detailed information about post-retirement earnings and consulting work in their Working in Retirement pamphlet and Retired Members’ Handbook.

For administrators contemplating retirement or post-retirement employment, these evolving regulations necessitate careful planning and ongoing attention to compliance requirements. The changing landscape of post-retirement employment in education requires a thorough understanding of current rules and potential future changes to ensure a smooth and compliant transition into retirement.

When you talk to your union representative, you might wonder how private that conversation really is. Can your employer force your union rep to tell them what you discussed? What about in court? This article explains what the law says about keeping conversations between union members and their representatives private, and how this compares to talks between lawyers and their clients.

How the Law Protects Talks with Your Union Rep

In 1981, an important decision was made that helps protect talks between union members and their representatives. The National Labor Relations Board (NLRB) said that employers can’t force union reps to share what workers tell them during grievance investigations. This means if you’re having a problem at work and talk to your union rep about it, your employer usually can’t make them reveal what you said.

New York is one of a handful of states that has even stronger protections. Here, the law says union representatives not only have a fiduciary duty to their members to maintain confidentiality whenever possible, but also have a common law privilege protecting union communications. In particular, the privilege covers communications, verbal and written, made in the performance of a union duty between association members and union officers. Importantly, the privilege operates only as against the public employer on matters where the member has a right to be represented by a union representative. Thus, union discussions with union officers are protected from being shared with the public employer—not against any other authority, such as a grand jury or a parent suing on behalf of their child. If an association member has potential criminal liability, we recommend discussing the situation only with an attorney.

Where the public employer directs a union member to divulge privileged communications with members, it’s an improper practice per se, and an improper practice charge should be promptly filed with the Public Employment Relations Board within the four-month statute of limitations.

Importantly, it’s incumbent upon the union representative during interrogations to object to questions that would privilege, otherwise the privilege is waived. Because it may not always be clear what communications are privileged, we recommend designating a SAANYS attorney as your union representative during any interrogations. SAANYS attorneys are trained to quickly identify privileged communications during interrogations and will quickly object to protect members’ rights.

What Kind of Talks Are Protected?

When you talk to your union rep, certain conversations are more protected than others. These usually include:

- Discussions about workplace complaints

- Talks about problems with management

- Conversations about union contracts

- Disciplinary discussion

But not everything you tell your union rep is automatically private. This is different from talking to a lawyer, where almost everything you say is protected by law.

How This is Different from Talking to a Lawyer?

When you talk to a lawyer, the law provides very strong privacy protections. These protections have been around for hundreds of years and are well-understood by courts. Almost anything you tell your lawyer must be kept secret, with very few exceptions.

The privacy of talks with union reps isn’t as strong or clear-cut. Courts in different states might treat these conversations differently. This means your union rep needs to be careful about what they write down or promise to keep secret.

When Privacy Protections Don’t Work

There are times when neither union reps nor lawyers can keep things private:

- If you’re planning to commit a crime

- If you’re trying to defraud someone

Also, unions sometimes need to handle matters as a group. This means your rep might need to share some information with other union officials. This is different from lawyers, who usually can’t share your information with anyone.

Confidentiality also can be put at risk if you are a witness in an official investigation conducted by your employer. While the NLRB’s longstanding policy was to enforce the confidentiality of such statements, a 2017 decision made by the board ruled that such statements must be produced by an employer if requested by your union. In this instance, however, the flow of information is from your employer to your union; unlike the protected information that you are entitled to when information is flowing from your union to your employer.

Real-World Example

Let’s say you’re having a problem with your supervisor and go to your union rep. You can tell the union representative about the issue without worrying that they’ll be forced to tell your boss. But if you bring a friend to the meeting, be aware that this might affect how private the conversation is. Your rep should explain this to you.

What’s Happening Now

While New York provides more protections for confidentiality than many other states, vigilance is always essential when ensuring your rights are being upheld. Always make sure to:

- Ask your rep about privacy before sharing sensitive information

- Understand that not everything you say is automatically protected

- Know when you might need to talk to a lawyer instead

What This Means for You

Your conversations with your union rep have some legal protection, but it’s not as complete as talking to a lawyer. Here’s what to keep in mind:

- Be clear about what needs to be private

- Ask questions if you’re not sure about privacy

- Remember that your rep might need to share some information with other union officials

Final Thoughts

While talks with your union rep aren’t as protected as those with a lawyer, they still have important privacy safeguards. Understanding these can help you make better decisions about what to share and when. Your union rep is there to help you and knowing how privacy works lets you make the most of their support while protecting yourself.

Jack Kelly; SAANYS Legal Clerk

On September 20, 2023, the New York State Commissioner of Education issued Decision No. 18,344, establishing a significant precedent for the administration of in-school suspensions and extracurricular activity suspensions. This ruling clarifies due process requirements for these disciplinary actions, emphasizing the necessity of parental notification and discussion prior to enacting a punishment.

The case originated from an incident involving an elementary school student in the Vernon-Verona-Sherrill Central School District who made a potentially threatening remark accompanied by a concerning hand gesture. Upon discussion with the student, who acknowledged the behavior, the school principal determined a one-day in-school suspension was warranted, to be served the following day.

The principal attempted to inform the family through multiple channels: an email sent near the end of the school day when the incident occurred, a follow-up email the next morning (the day of the suspension), and a physical letter mailed to arrive two days post-incident.

The student’s family contested this approach on two grounds: they argued that the in-school suspension was an excessive punishment and that due process was not afforded to them in the disciplinary process. The school district countered, asserting that in-school suspensions are not subject to the due process procedures outlined in Education Law § 3214.

The Commissioner’s ruling, however, establishes that students and parents must be given an opportunity to discuss the circumstances underlying a proposed disciplinary action with the authorized school official before its implementation. This applies to both in-school suspensions and extracurricular activity suspensions, which are now considered forms of removing a student from regular school activities. The only exception to this requirement is if the student poses an immediate danger to individuals or property or presents an ongoing threat to the academic process.

For school administrators, this decision represents a significant expansion in the interpretation of § 3214. Previously, in-school suspensions were not subject to the same hearing requirements as out-of-school suspensions. While in-school suspensions still do not require formal hearings, the new ruling indicates that simply leaving voice messages, sending emails, or mailing letters is no longer sufficient notice of punishment; parents must be given a genuine opportunity to respond during school hours before any suspension is implemented.

It is important to note that the decision does not explicitly address non-suspension disciplinary actions, such as lunch detentions. The applicability of these new requirements to less severe forms of discipline remains unclear.

Moving forward, administrators must be proactive in informing parents of potential disciplinary actions as soon as practicable. Providing parents with sufficient time to respond during school hours is crucial, as this case demonstrates that after-hours notification does not constitute adequate opportunity for discussion prior to student suspension.

In situations where immediate disciplinary action is necessary due to a student posing “a continuing danger to persons or property or an ongoing threat of disrupting the academic process,” the student may be removed without prior discussion. If you believe that a situation with a student is rising to the level of active threat, be sure to have the building Principal or the administrator handling the incident to thoroughly document the event and any escalation of the student’s behavior from disruption to active threat in order to demonstrate compliance with due process requirements.

Jack Kelly; SAANYS Legal Clerk

The Deposit Administrators and Supervisors Association has recently achieved a significant milestone in its ongoing efforts to improve working conditions and benefits for its members with the assistance of David Thon, SAANYS Labor Relations Specialist. After extensive negotiations, a new Collective Bargaining Agreement has been ratified and subsequently adopted by the Deposit Central School District Board of Education. This agreement, which will be in effect for the 2024-2027 school years, represents a substantial step forward in several key areas, including compensation, longevity awards, holidays, and retirement incentives. These updates, detailed below, reflect the Association’s commitment to ensuring fair and competitive benefits for its members.

Compensation and Salary Increases

Effective June 10th, 2024, all members of the Association are set to receive a significant boost in their financial packages. This comprehensive enhancement includes a Memorandum of Agreement for a cash payout, the details of which will be communicated separately to each member. Additionally, there will be a substantial base salary adjustment of 4%, providing an immediate and tangible increase to members’ earnings.

Following the initial adjustment, members will see a structured series of raises over the next three years:

- For the 2024-2025 school year, a 1% salary increase will be implemented.

- For both the 2025-2026 and 2026-2027 school years, members will receive a 2.5% salary increase each year.

When calculated cumulatively, these increases equate to a base salary increase of 10.36% for all members over the life of the Agreement. This translates to an average increase of 3.9% to 4.8% per year, taking into account the longevity schedule. This represents a marked improvement from the previous Agreement. Under the last contract, members received only a 3% annual salary increase, resulting in a total base salary increase of 9.27% over the life of that Agreement.

Longevity Awards

In recognition of the dedication and long-term commitment of its members, the Association has successfully negotiated substantial increases to the longevity award structure. These changes not only increase existing awards but also introduce new milestones to reward extended service. The updated longevity award schedule is as follows:

- The initial longevity award has been doubled from $500 to $1000, providing a more substantial recognition for early career milestones.

- The 10-year award has been raised from $1000 to $1750, a 75% increase.

- The 15-year award has seen a significant boost, increasing from $1500 to $2500, representing a 66.7% increase.

- The 20-year award has been elevated from $2000 to $3250, a substantial 62.5% increase.

In addition to these enhancements, the new Agreement introduces two new milestone awards:

- A $4000 award for 25 years of service, recognizing a quarter-century of dedication to the district.

- An impressive $4750 award for those who reach the remarkable milestone of 30 years of service.

These changes represent a significant improvement over the previous Agreement, which saw no alterations to the longevity awards aside from the introduction of the initial $2000 award for 20 years of service.

Health Care and Insurance Benefits

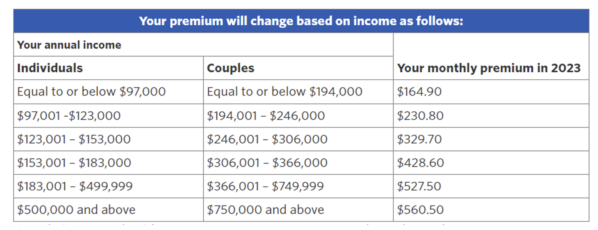

While Vision and Dental coverage remain unchanged under the new Agreement, there have been notable modifications to health care plans. In a move to maintain stability, contributions for health insurance will remain at their current levels. However, in an effort to provide more flexibility and potentially cost-effective options, members will now have the choice to opt for a Medicare Advantage Plan for their coverage.

It’s important to note a significant change for new employees joining the district. Effective July 1st, 2024, newly hired staff will no longer qualify to receive a health care waiver if they have a spouse employed by the District who is already on the health care plan. It’s crucial to emphasize that this change will not affect current employees, who will continue to enjoy their existing benefits.

In terms of life insurance, the district has implemented a cap on policies at $100,000, based on past practice. This represents a departure from the previous system where employee life insurance policies were determined by individual salary levels.

Additional Paid Holiday

In a move that aligns with recent federal and state recognitions, the district has agreed to add Juneteenth as a paid holiday for Association members. This addition brings the total number of paid holidays from 13 to 14 annually, enhancing the work-life balance for all members.

Juneteenth, observed on June 19th each year, commemorates the final enforcement of the Emancipation Proclamation and the subsequent ending of slavery in the United States. It was officially recognized as a federal holiday in 2021 and has been observed as a state holiday in New York since 2020.

Retirement Benefits

The new Agreement also brings significant enhancements to retirement benefits, providing members with increased financial security as they plan for their future beyond their active careers.

Firstly, the Association has successfully negotiated an increase in its contribution to member retirement plans. The contribution has been raised to $14,000 from the previous $12,500, representing a $1,500 increase. While this increase is smaller than the $2,500 bump seen in the 2021-24 Agreement (which raised the contribution from $10,000 to $12,500), it still represents a meaningful enhancement to members’ retirement savings.

Perhaps the most dramatic change in retirement benefits comes in the form of sick day payouts. Under the new Agreement, sick day payouts have increased from $20 per day to $75 per day, a remarkable 275% increase. This change significantly enhances the value of accumulated sick days for retiring members, potentially providing a substantial financial boost at the end of their careers. The magnitude of this increase is particularly noteworthy when compared to the previous Agreement, which saw only a $5 per day increase in sick day payouts.

These enhancements to retirement benefits underscore the Association’s commitment to supporting its members not just during their active careers, but also as they transition into retirement. The increased retirement plan contributions and the substantial boost in sick day payouts combine to provide a more robust financial foundation for members as they conclude their service to the district.

The newly ratified Collective Bargaining Agreement between the Deposit Administrators and Supervisors Association and the Deposit Central School District Board of Education represents a significant step forward in terms of compensation, benefits, and recognition for the district’s administrative and supervisory staff. With substantial salary increases, enhanced longevity awards, improved retirement benefits, and the addition of a new paid holiday, the Agreement reflects a mutual commitment to valuing the contributions of these essential educational professionals.

SAANYS Legal Article – Brett D. French, Esq.

May 1, 2024

Many districts offer an employer-sponsored Internal Revenue Code Section 403(b) tax-sheltered annuity plan, similar to a standard IRC Section 401(k) plan. A 403(b) plan is a tax-advantaged retirement account offered to employees of public schools, public universities, some

churches, and other 501(c)(3) charities. Much like a 401(k) account, an employee may electively

contribute to the 403(b) account pre-tax, with the contributions deducted from your taxable income

for the year the contribution was made. The elective contribution limits of the individual for a

403(b) plan are currently $23,000. After age fifty, the educator may also contribute an additional

$7,500.00 catchup amount as well for a total of $30,500.00 each year.

403(b) plans also provide for non-elective contributions, which would include employer

contributions on behalf of the employee (such a 1% of salary annually) or upon retirement for

structured payments of incentives or leave (vacation or sick leave) payouts upon separation. The

elective (that which the employee contributes) and the non-elective (payments upon separation)

contributions for 2024 may total $69,000.00. This is important to note as many times our unit

contracts include retirement incentives, or leave accrual buyouts that are greater than $69,000.00.

If the total amount of the buyouts would exceed the 403(b) contribution limit for the year, the IRC

allows that the remainder amounts may be paid out in successive calendar years up to five years

after separation. Whereafter, any remaining amount must be paid in cash.

The advantage to receiving payout monies as employer non-elective contributions is that

the employee (and employer) forever avoid paying payroll taxes which total 7.65% of the total

sum, a nice savings. Also, the income tax consequences only kick in when the retired educator

withdraws the money from the 403(b) in retirement, presumably when they are in a lower tax

bracket.

One important tax consideration is that the leave buyouts cannot have an annual cash

feature. For example, if a school district has a annual cash buyback of vacation leave, it is

prohibited under the IRC to have a non-elective 403(b) contribution for vacation leave upon

retirement. So, either the annual vacation leave payment must be made as an employer 403(b)

contribution or the retirement payment must be paid as cash, which means the retiring employee

will lose the 40% of the money upon payment. SAANYS prefers sheltering all the money.

Likewise, the collective bargaining contract cannot provide that leave buyouts will be paid to the

educator’s estate if he/she dies in service. Such a provision will violate the IRC’s substantial risk

of forfeiture test. Thus, it is critical to consult with SAANYS and draft clear language to

differentiate which payments are to be made to a 403(b) account and which should be paid out in

lump sum cash payments to the retiree as well as eliminating any payments to an educator’s estate.

This is often a consideration when working out a settlement agreement for the resignation or

retirement of a member from a district.

While 403(b) retirement accounts are a beneficial investment tool, as well as a way to

reduce taxable income, there is a caveat that the money is not normally accessible until the age of

59 1/2 without penalty. One distinct exception exists that our members should be aware of, the

rule of 55. It is oftentimes relevant for our retirees, and should also be built into contracts which

account for 403(b) accounts provided for by employers.

The Rule of 55 allows penalty-free withdrawal from a current employer’s 403(b) account

if you leave the job during the calendar year during which you turn 55 years old or thereafter. If

you in fact do retire at 55 or afterwards from your employer,and have a period of time where you

are not again reemployed, then you may elect to withdraw from your 403(b) penalty free. While

these withdrawals will be subject to standard income taxes, they will not incur the 10% penalty.

An exception to the exception is that the employer’s 403(b) plan must allow for the Rule of 55

early withdrawal. This is important to note as our units and members should discuss this when

negotiating their contracts to ensure their employer’s plan does in fact allow for the Rule of 55

early withdrawal.

How would this play out? For many of our members, they may elect to retire at the age of

55 from their district, and they may also elect to retire through TRS, though not all who retire from

their district at 55 may elect to retire through TRS. If you elect to retire from your district at the

age of 55, but not from TRS, or not from all employment generally, then an election to withdraw

from the 403(b) account would need to happen prior to taking on any new employment. Should

you become employed again, you would no longer be able to take a withdrawal from the 403(b)

account and your Rule of 55 window will have closed.

While this may not seem to be an advantageous exception to the limits of being able to

access a 403(b) account until 59 ½, there are times when this might be helpful to allow for some

level of a transition from one position to the next, or until you may desire to draw from your TRS

retirement.

As all investment, tax, and accountings strategies are personal, and come with their own

exceptions and caveats, we always recommend that you consult with a financial advisor and tax

professional prior to making any such election.

Scope of SAANYS Legal Representation

One aspect of SAANYS’ membership benefits that can often be confusing is the scope of legal services offered by SAANYS Office of General Counsel. The Office of General Counsel provides legal advice and representation to SAANYS member units and individual members in matters involving collective bargaining, contractual grievances, violations of the Taylor Law—including unilateral changes to the terms and conditions of members’ employment, violations of members’ tenure rights and other matters arising under the NY State Education Law, and employee discipline—including responding to counseling memos and representation in termination proceedings.

SAANYS does not provide representation in matters involving a member’s private right of action. Private rights of action include claims of sexual harassment, discrimination based on a protected class, and hostile work environments. They also include tort claims, such as negligence, assault, defamation, interference with a prospective business opportunity, and infliction of emotional distress, among others. The distinguishing feature of a private right of action is that it allows the member to seek monetary damages, apart from lost wages, and may result in an award of attorney’s fees.

While SAANYS may be able to assist members in the preliminary stages of addressing conduct that resulted in a private right of action, such as by communicating with a school district and demanding an investigation, mediation, or some other resolution, SAANYS cannot represent a member pursuing a private right of action by filing a formal complaint. Such complaints may be filed with the New York State Division of Human Rights, the Equal Employment Opportunity Commission, New York State Supreme Court, Federal District Court, or may be referred to a state or federal prosecuting agency.

SAANYS Personal Legal Plan

Although SAANYS Office of General Counsel cannot represent members in private rights of action, SAANYS has partnered with the law offices of Feldman, Kramer & Monaco, P.C. to offer SAANYS members discounted legal services, including two free hour-long consultations and discounted hourly rates for legal services provided thereafter. SAANYS members who enroll in the Personal Legal Plan have access to the skilled attorneys at Feldman, Kramer & Monaco, P.C., who can discuss matters such as filing a formal complaint in a private right of action.

In addition, SAANYS members who enroll in the Personal Legal Plan receive simple estate planning services, including a simple will, power of attorney, health care proxy, living will, and unlimited advice via telephone. The annual rate for enrolling in the Personal Legal Plan is $85. To learn more about the Personal Legal Plan or to enroll, please contact Feldman, Kramer & Monaco, P.C. at 1-800-832-5182. Be prepared to present your membership ID #.

The School Administrators Association of New York State’s (“SAANYS”) General Counsel, Art Scheuermann recently successfully prosecuted a contract grievance for Nassau Community College Administrators’ Association (“Association”). The grievance involved the Nassau Community College’s (“College”) refusal to pay retroactive salary increases to certain Association members claiming that the members’ positions were not placed into the union until after the expiration of the inaugural contract. At the arbitration entitled In the Matter of Nassau Community College Administrators Association v. ‘Nassau Community College, Arbitrator Jay Siegel issued an Opinion and Award holding that the first collective bargaining agreement (“CBA”) contract expressly provided that the new titles not only were placed in the bargaining unit before the contract expired, but also that the Association members in the at-issue titles were entitled to retroactive salary increases from when they were hired.

The Association was certified as a union in 2017. Thereafter the Association and College negotiated for the union’s first CBA for nearly six (6) years. During negotiations that included mediation and fact finding, multiple disputes arose over the titles that should be within the bargaining unit that resulted in the Association filing four improper practice charges and a unit clarification/placement petition. In late 2021, the parties reached agreement on the remaining terms and conditions of the contract, including wages as well as resolution of all the litigation matters.

On March 4, 2022, the College sent the Association the final draft CBA with an accompanying cover letter which stated that the final CBA reflected “all the terms and conditions the parties have agreed to.” The College’s letter further acknowledged that the CBA recognized three groups of titles, namely: (1) the titles certified in a 2017 Order by the Public Employment Relations Board (“PERB”); (2) the stipulated titles agreed to in a January 2018 settlement agreement; and (3) several titles the parties agreed to add before the end of the negotiations. The last group included the titles held by seven (7) of the Association members that were denied retroactive raises.

As part of the global settlement of the contract and litigation, the College and Association signed a stipulation to include additional titles of the seven members in the bargaining unit. The stipulation, known as the “Composition MOA”, stated that the at-issues titles be placed into the Association “effective on the date of full execution of this agreement.”

The central issue in the grievance was whether the CBA expressly provided for the at-issue employees to receive negotiated salary increases during the five-year contract period. Notably, the express language of the CBA entitled all Association titles, including the titles at-issue here to receive annual raises. As such, the Arbitrator correctly determined that such retroactive salary increases must be granted to the at-issue employees.

Contrary to the foregoing, the College took the position that the at-issue Association members were not entitled to retroactive compensation because they did not become members of the bargaining unit until after the expiration of the 2017-2022 CBA, when the Composition MOA was executed.

Ultimately, as set forth above, the Arbitrator determined that the language of the CBA was clear and unambiguous and that the at-issue employees were entitled to retroactive salary increases, except for the years when they received a salary increase due to a change in title or promotion. Arbitrator Siegel, observed that,

“[t]here is nothing in the list distinguishing the way that any of the represented titles should be treated, i.e., that employees in certain titles should receive the retractive salary increases and that employees in other titles should not. Since there is nothing in the CBA indicating that these groups should be treated differently, the only logical conclusion to reach is that all unit members should have all provisions of the CBA applied the same way.”

In the end, this case highlights the extreme importance of negotiating clear and unambiguous contract language that expresses the parties’ mutual agreement of every term collectively bargained. Arbitrator Siegel held that “in the end analysis, if there truly was a meeting of the minds to deny retroactivity for the at-issue employees, it needed to be reduced to writing. While the Composition MOA can be interpreted to mean that the at-issue employees did not become unit members until it was fully executed, the plain language of the CBA is far more compelling evidence. When it is read in the context of the parties’ overall agreement, it becomes abundantly clear that the at-issue employees are eligible for retroactivity.” (emphasis added).

Before any collectively bargained agreement is finalized, we highly recommend that members contact a SAANYS attorney to review the prospective contract language and provide feedback before the parties sign any contract. (emphasis added). While intent may be inferred in some instances, ambiguous contract language can cost Association members hundreds if not thousands of dollars. When the contract language is clear and unequivocal it allows SAANYS to enforce the plain meaning of the contract.

Download the PDF of this article

Are you a SAANYS member in the process of planning for retirement? If so, this article

provides you with information that is imperative to your successful transition to a stress-free

retirement.

The process of retirement involves two (2) aspects. The first one involves your local

district, BOCES, or community college, and the second aspect is the applicable retirement

system rules under which you retire: the New York State Teachers’ Retirement System

(“NYSTRS”), New York State Employee Retirement System (“NYSERS”), or a defined

contribution retirement plan like TIAA-CREF. Retirement planning should be done throughout

your career. You should be in contact with the applicable pension system and your financial

advisor well before retirement. SAANYS provides many opportunities to sit down with

financial advisors to review whether you have adequately planned for retirement. In considering

retirement, a further question to ponder is how you will occupy yourself in retirement with an

additional 60 hours of free time each week. Retirement has been sometimes described as “every

day is Saturday”, so consider how you are going to use your well-deserved time.

As it relates to the first aspect, the employer level, recently a high number of members

has asked questions relating to the submission of Letter of Retirement, the form such letter should

take, and most importantly, the contents of said letter. A Letter of Retirement in sum and substance

puts your respective district, BOCES or community college on notice of your intention to retire. If

you are a member who is a beneficiary (as a member of a union) of a collective bargaining

agreement (“CBA”) with your respective employer it is important to review your CBA to

determine which, if any, contractual provisions relate to retirement as soon as possible. Why as

soon as possible? To ensure you are able comply with the contractual retirement notice provisions.

Some CBAs require advanced notice of retirement of a year or more.

Contractual notice provisions are commonly seen in CBAs where the district offers an

incentive to the retiree upon first eligibility to receive a pension without penalty, provided the

employee provides the district with the advance notice of the retiree’s intent to retire within the

applicable time. A notice to retire can take multiple forms; however, it must comply with the

CBA’s filing deadline. If the member’s Letter of Retirement is not filed within the timeline set

forth in the CBA, the member/retiree will be unable to retire at the desired time and will likely end

up working for an additional period than desired to receive the hard-warned contractual benefit

or lose the retirement benefit altogether.

An example of the foregoing is as follows:

-2-

“A unit member who notified the Superintendent of Schools of their

intent to retire no later than February 1st of the school year during

which their resignation become effective, shall be eligible to receive

a retirement benefit equal to two (2) percent of the member’s actual

salary during his or her last year of service.”

See CBA at Article X (Citation for illustrative purposes only).

In addition to the foregoing, we encourage members to thoroughly review their CBA or

individual contract for other provisions which become effective or are “springing” contractual

provisions, meaning as a result of their intent and desire to retire, the contractual provisions kick

in and become effective. These provisions range from accruals of fringe benefit buyouts to retiree

healthcare provisions. Within your Letter of Retirement, we encourage members to spell out the

applicable provisions and entitled contractual benefits you expect to receive to ensure your

respective district provides them.

Further, your Letter of Retirement should also include a “catch all” statement that you

receive every entitled benefit pursuant to the CBA and not waiving any possible benefits which

you may have accidentally omitted from your Letter of Retirement.

An example of the foregoing language is as follows:

“Dear Dr. Superintendent and Esteemed Members of the Board of Education:

Please allow this letter to serve as notice to you of my intent to retire from my position as

Director of Special Education in the Example Central School District. My retirement date shall

be effective on the close of business on Monday, January 29, 2024.

As set forth below, I am contractually entitled to the following benefits pursuant to the

Example Administrators Association Collective Bargaining Agreement dated effective July 1,

2023 (the “CBA”); however, to the extent I am contractually entitled to any other benefits not

specifically stated herein, I respectfully request such benefits also be provided.

Pursuant to Article VIII, Section C of the CBA, by providing this notice 6 months prior to

my retirement date, I am eligible for the retirement incentive.”

The foregoing, while for illustrative purposes only, provides a strong framework for

submitting your Letter of Retirement to your respective employer. Of course, personalization of

your Letter of Retirement including thanking your respective superintendent and board of

education for your opportunity to serve the district is likewise appropriate. However, such

personalization is not mandatory nor required.

Once you have satisfied your district-level notice requirements for retirement, then it is

important to review and effectuate the pension system’s requirements to receive a pension,

including your retirement application. If you are eligible to buyback prior service, this task should

be completed well in advance of your retirement. SAANYS’ experience has been the longer a

member waits to buy back service, the greater the likelihood critical records may be misplaced,

lost, or destroyed.

-3-

You must review the NYSTRS or NYSERS requirements about retirement. You may retire

as early as age fifty-five (55) if you have at least five years of NYS credit if you are Tier 4. Your

employment contract must end at least one day before your retirement date (e.g., if you are under

contract through June 30, your earliest retirement date would be July 1).

Early in the school year in which you plan to retire, SAANYS recommends that you

schedule a “benefits consultation”. You can meet with a NYSTRS representative in person at

NYSTRS. After the pandemic, NYSERS does not hold in person consultations any longer. Or,

you can NYSTRS or NYSTRS by phone, personal device video, or by video at various sites around

the state. An in-person retirement conference is also invaluable. Some members have complained

that they did not learn about certain important aspects over a phone conference. Post pandemic,

NYSTRS is scheduling in-person such conferences months in advance.

At the pension consultation you can review your service credit history again. You may want

to update your benefit estimate if you know salary information. You can also learn how to file for

retirement online. You may also visit the benefits consultations page of the NYSTRS/NYSERS

website at NYSTRS.org or ERS at http://web.osc.state.ny.us/retire for information on scheduling

a consultation.

If a consultation is simply not possible due to time constraints or otherwise, you can always

request a personalized estimate by calling NYSTRS at (800) 348-7298, Ext. 6020 or using the

Benefit Estimate Request form found at NYSTRS.org. NYSERS has a similar call in and on-line

consultations and estimates.

New state laws impacting NYSTRS members are generally deemed to take effect no later

than June 30 of the year the legislation is enacted. Therefore, if your retirement date is on or after

July 1, you may still benefit from legislation signed into law later in the calendar year you retire.

One example would be a state-wide retirement incentive. If you retired after July 1, you would be

eligible for the benefit provided your employer opted for it.

To retire, you must file a completed Application for Retirement with NYSTRS/NYSERS

by your retirement date, but no more than ninety (90) days before.

The Application may be filed online through MyNYSTRS, which is accessible at the

following link: https://secure.nystrs.org/MyNYSTRS/.

To be on the first available payroll after retiring, you should file thirty (30) days in advance

of your retirement date.

If you plan to retire on the cusp of a key milestone, be aware that falling short of the credit

needed could negatively impact your retirement benefits — for life. Do not cut it too close when

picking a retirement date; work longer than you think necessary, even if this is by a week or two.

Also consider filing your application just a few weeks before your retirement date (e.g., by

mid-June for a July 1 retirement). If your district sends timely reports to NYSTRS, you may have

met the milestone when the preliminary calculation runs, which could mean higher initial

payments until your retirement benefit is finalized by NYSTRS.

-4-

You may withdraw a service retirement application or change your retirement date only if

NYSTRS receives your signed request within fourteen (14) days after your retirement date. Further

NYSTRS must receive any payment option change within thirty (30) days after your retirement

date.

As in contract law with what is referred to as the mailbox rule, documents mailed to

NYSTRS will be considered filed on the day they are mailed if they are mailed by registered or

certified mail via the U.S. Postal Service, or by an equivalent delivery service that provides mail

tracking and is approved for use by NYSTRS.

SAANYS legal team recognizes that the retirement process can be stressful and even

daunting, our in-house team of attorneys look forward to assisting with you all questions regarding

this milestone in your career and congratulate all SAANYS members in advance of their planned

retirement.

Overview

When you or one of your unit members are faced with the prospect of a lengthy leave of absence

because of a medical or family-related emergency, it is important to know that the duration of leave

is not necessarily limited to contractually accrued sick time. The Family and Medical Leave Act

(FMLA) requires private and public employers in the United States to provide unpaid, jobprotected leave to employees for medical and family related care, including the care of immediate

family members.

Under FMLA, eligible employees may take up to 12 weeks of FMLA leave every 12 months.

FMLA leave may be taken as a continuous period of leave; it may be broken up throughout the

designated 12 month period on a day-by-day basis; it may be used to reduce hours worked daily,

if medically necessary.

This article will discuss some general principles of FMLA leave and also address issues specific

to public school administrators, including the consequences of taking FMLA leave on pension

calculations and the duration of a probationary appointment.

Eligibility for FMLA Leave

In order to be eligible for FMLA leave, employees need to have worked for their current district

for a total of 12 months. The 12-month eligibility period need not be continuous.

Further, the employee must have worked for the district at least 1,250 hours in the 12 months

immediately preceding the requested leave. 1,250 hours is roughly equal to 24 hours a week over

the course of a calendar year.

Finally, the employee must be employed in a district that has at least 50 employees. Accordingly,

employees in some of the smallest districts may not be eligible.

Employers are required to grant FMLA leave to care for serious health conditions experienced by

employees, their children, their spouses, or their parents. A serious health condition renders the

employee unable to perform some or all essential job functions, including absences required to

attend necessary medical appointments. FMLA leave is also available for bonding time following

childbirth or adoption.

Requesting FMLA Leave

SAANYS recommends that, when requesting FMLA leave, members do so in writing, stating the

reasons the leave is requested. The notice should be provided as soon as it is foreseeable, and,

excepting emergencies, at least 30 days before leave will be required. Members should reach out

to a SAANYS representative if they have any questions about requesting FMLA leave. Note that

employers are permitted to request information from an employee’s medical provider before

granting a leave request. Generally, the employee will have 15 days to provide the requested

information.

Calculating Leave Time

Under FMLA, the employer designates the 12-month period based on which an employee’s 12

weeks of leave is calculated. The employer may designate the 12-month period in one of four

ways: (1) the calendar year (Jan. 1 to Dec. 31); (2) any other fixed 12-month period, including

individual periods commencing on each employee’s start date; (3) the 12 months beginning the

date on which the employee first requests leave; or (4) a backward-looking 12-month period,

where, for any leave requested, the employer will look back 12 months to determine whether any

leave has been taken, and what amount of leave remains.

Generally, FMLA leave may be taken all at once or, when medically necessary, intermittently in

weeks, days or even hours. FMLA leave may only be charged to an employee for time actually

taken, and time that an employee is not scheduled to report to work does not count against the

remaining leave time available.

Concurrent Use of Contractual Sick Time, Pensionability, and Tenure

Contractually accrued sick time may be used simultaneously with FMLA leave, and employers

may require that it is. Periods of FMLA leave during which contractually accrued sick time is in

use count toward employees’ pension benefits under TRS and toward the completion of

administrators’ probationary appointments. Any FMLA time that is taken after contractually

accrued sick time runs out, or any time when an employee is permitted and elects to take FMLA

leave non-concurrently is not pensionable and will not contribute to a tenure determination.

Employee Protections During and After Leave

Continuation of health insurance. Employers must continue an employee’s health insurance

benefits during FMLA leave as though the employee was not on leave.

Prohibition on discrimination. Employers are forbidden from retaliating against employees who

request or use FMLA leave. Retaliation includes, discipline, threats of discipline, negative

performance reviews, or denial of a promotion or other rights based on leave taken or requested.

Returning to work. Following FMLA leave, employees have the right to return to the same position

they previously occupied or an equivalent job that provides the same, pay, benefits, and other terms

and conditions of employment.

Members are encouraged to contact a SAANYS representative if they feel their FMLA rights or

protections have been violated.

Download the PDF of this article.

The legal department at SAANYS consistently handles several calls throughout the day from members and unit leadership regarding a member being notified by their district that the member has been summoned to appear for questioning, regarding an incident, claim or point of concern from the district’s perspective. From a legal perspective, it is our intention to advise the unit leadership and the member as to what they can expect during questioning, what their rights are, and what they should do when questioned. Many times, our legal advice will advise the unit leadership as to how to represent the member during questioning or having legal representation present during the meeting. This article will touch on some general legal theories that all administrators and unit leadership should be aware of, and some pointers for how to go about being interviewed and/or representing someone being interviewed. Keep in mind, we often call them “interrogations,” as many times that is exactly what they are. While the term carries with it a level of significance, and has an adversarial undertone, recognizing the potential magnitude of the situation can be helpful, in and of itself.

First and foremost, a general note is that the district is not required to notify an administrator, or unit leadership, what the purpose of the questioning is, or what the subject matter of the questioning will be. While this can be quite perplexing, this is an unfortunate reality. What we advise our unit leadership to do, is, if possible, build relationships with the district. In building these relationships, oftentimes the district may provide some insight in advance of a meeting as to what that meeting will be about. The same goes for connecting with SAANYS and looking to see if SAANYS legal counsel can inquire in advance of the meeting as to what topics the interview will cover. While this will not always produce helpful information, many times it will. There is one caveat however which is to note that the district is not required to identify what the interview will be about. If the questioning may result in “disciplinary action” against the administrator being questioned, the administrator must be notified of such, and the administrator has the right to have union representation present, whether a fellow unit member, or a SAANYS attorney. While this may not be a notice consisting of the subject matter of the meeting, we at least know that the person being interviewed may very well be the current or eventual target of a counseling memo or even disciplinary charges.

As noted, if the interview may result in “disciplinary action” against the member being interviewed, the district must notify the member in advance and allow for union representation during the meeting. Failure to do so may cause the interview to be thrown out or deemed illegitimate. Important to remember is that the administrator must request a representative before questioning occurs. Always be aware though, that a district may be able to claim that though they did not anticipate the interview would result in “disciplinary action”, the defense exists that the district only learned of conduct later during the interview that could then result in “disciplinary action.” Be vigilant to seek union representation regardless of whether the district notifies our member that the interview may result in “disciplinary action”.